Welcome to

Sigrist, Cheek, Potter & Huyser

CERTIFIED PUBLIC ACCOUNTING FIRM

Certified Public Accountants committed to helping you achieve the highest return on your investment.

Client Services:

Our firm offers a wide range of services to our individual and business clients. Because our firm is relatively small, our clients benefit by getting personalized quality service that is beyond comparison. Below we have listed the services that we offer to our clients along with a brief description. As the list below is by no means all-inclusive, please feel free to inquire about a service if you do not see it listed.

Client Services:

Our firm offers a wide range of services to our individual and business clients.

Because our firm is relatively small, our clients benefit by getting personalized quality service that is beyond comparison.

Below we have listed the services that we offer to our clients along with a brief description. As the list below is by no means all-inclusive, please feel free to inquire about a service if you do not see it listed.

- Tax Services

- Consulting Services

- Accounting Services

- QuickBooks setup, support and training

- Business startup services including LLC/S Corporation formation

- Tax consulting and planning

- Income tax preparation for all types of businesses and individuals

- Payroll and Sales Tax reporting

- Monthly bookkeeping

- Financial statement preparation

- Virtual Accounting Services

Our Mission

We believe in the value of relationships with every client, and our success is a result of your success.

We are committed to providing close, personal attention to our clients.

Our continual investment of time and resources in professional continuing education and state-of-the-art computer technology is indicative of our commitment to excellence.

Why Choose Us

Our experience includes working for two of the largest accounting firms in the world with clients ranging from sole proprietors to Fortune 500 companies.

Equally important, we have hands-on experience operating small and medium-sized companies in the positions of CEO and CFO.

This means we have lived many of the challenges and opportunities you face in running your business and personal lives.

We have the foundation of knowledge and experience within our company to find solutions to problems and help you achieve the success your opportunities present.

Above all you get big-firm experience with personal small-firm service.

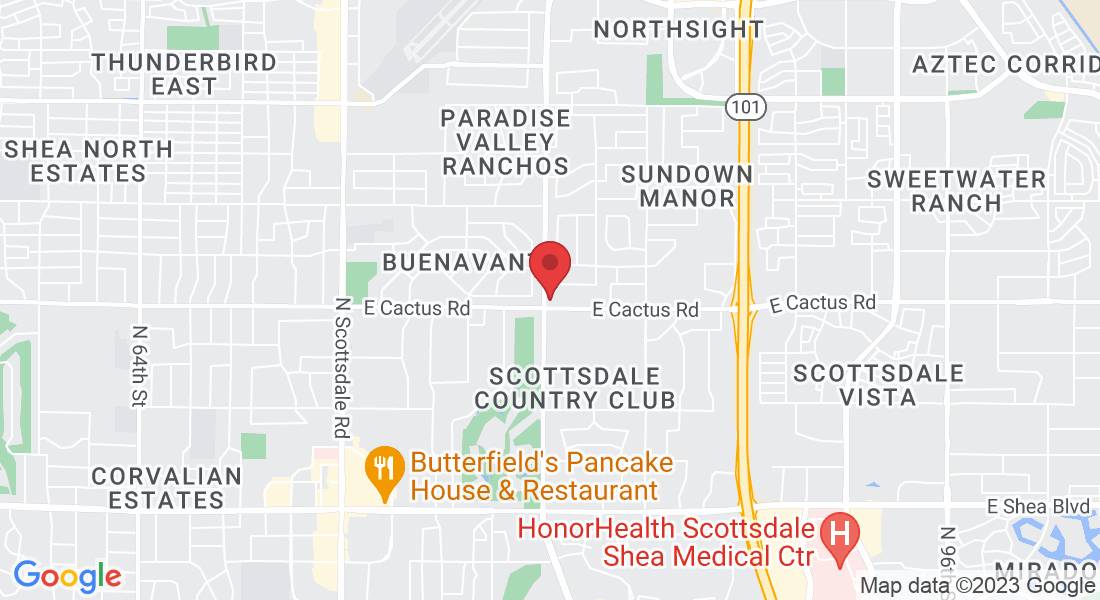

Contact Us